In many cases the owner of rare memorabilia is unaware of the current market value of this significant estate asset thereby leaving the CPA, the estate planner and/or trust attorney in the dark. In dealing with rare books and documents, as with fine art, there are definite procedures for determining valuation. Where tax issues are involved, the agency’s own appraisal staff reviews valuations, with some subject to further review by the Art Advisory Panel, a group of 25 volunteer experts. In 2010 the panel reviewed 475 estate tax items valued at $235 million, and recommended adjustments on more than half the items with a 43% increase on the undervalued items in estate and gift appraisals.(1)

In the case where you are valuing an item for purposes of insurable loss the model used is replacement value,(2) which is defined as: The amount it would cost to replace an item with one of similar and like quality purchased in the most appropriate marketplace in a limited amount of time. The process used when valuing for purposes of a tax deduction and/or estate valuation is fair market value,(FMV)(3) which is defined as: the price at which property would change hands between a willing buyer and a willing seller, neither having to buy or sell, and both having reasonable knowledge of all the relevant facts with little or no time restraints. The process used for equitable distribution, considering the likelihood for immediate sale, is dependent on a more immediate buyer and therefore defined as distress market value, the lowest value attainable. In the insurance setting, as the replacement value is normally based upon the less immediate retail backdrop it is substantially higher than that gleaned from the sophisticated private dealer or auction transaction.

Within these models, for the appraiser, rests the concomitant vagaries of subjectivity. To what degree is the ultimate value effected by: author, author plus content (or purpose), content alone or scarcity, with all dependent upon condition? The answer, of course, is a combination of all of the above. John Carroll University in Ohio recently received an iconic collection of Lincolniana, rare books and documents signed by or relating to Abraham Lincoln. The university sought replacement value for insurance purposes while the donor sought a fair market value determination for personal tax use.

WHERE THE MODELS PRODUCE DIFFERENT VALUES …………….

The documents in the collection include a Draft Order for Ohio’s 11th District, a classic Civil War document with the president’s full signature that affected the lives of 621 souls. This item has: author, content, rarity and is in exceptionally fine condition and is valued for timely replacement purposes as currently offered at retail at a price in 6 figures but, the fair market valuation for donation tax credit is over 1/3 less. In this case the lesser fair market value was determined by taking note that a sophisticated museum director, who constantly scours the market, eventually purchased a similar document and reported paying that much less than the current asking price at a popular and respected dealer’s….. the FMV results are those of a willing buyer and a willing seller with time on their side and no pressure to act.

WHERE THE MODELS DIFFERENCE IS BLURRED…………….

Another item is a political lithograph, 20 x 25 inches, with the bust portraits of the first 16 presidents printed to honor Lincoln’s 1st inauguration. This political memorabilia became very difficult to sell in 1861 owing to Lincoln’s changed appearance, he had a newly grown beard. Many copies were simply distributed by the printer and left to deteriorate. Here is an obtainable item whose collectability is dependent upon condition. With many pieces available at varying levels of quality, the market is broad, requiring buyers to rely on reputable dealers for condition assessment and authentication, causing the difference in valuation for replacement and fair market value to be blurred.

WHERE THE DIFFERENCE IN MODELS SEEMS NOT TO EXIST…………….

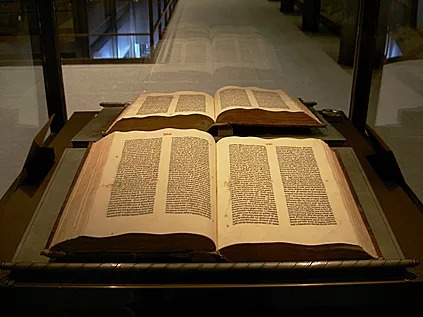

Moving to rare books, the gift to the university included a book in the collection that combines singular rarity and great purpose. This book is a curious and unusual soldier’s autograph album owned by a corporal from the first Rhode Island Volunteers. The signatures of Scott and Burnside and Sprague, at average, for the collector, command a reasonable price. However, the rare, full signature of Abraham Lincoln, in the context of an autograph album for a Union Army non-commissioned officer, two months after the start of the conflict, suspends convention and sets this album apart from the ordinary. It is clear to me that the President meant this autograph along with those of his generals as a meaningful gesture to the common soldier under his supreme command. It is with this fact in mind that I determined the standard minimum value of this full signature, and the others, and then valued them contextually as a rare and meaningful collection at a two times multiple of the signatures alone. In this case there is no known replacement and, as such, there can be no difference between fair market and replacement value.

Finding the proper market within the models with which to establish the valuation of specific rare books and documents determines and effects the eventual valuation. Although by definition, appraisals are subjective, it is an effort that relies upon an established process that requires research, factual support and dialogue with a combination of experienced dealers and authorities.

(1) Art Advisory Panel of the Commissioner of Internal Revenue, Annual Summary Report, www.irs.gov/pub/irs-utl/annrep2010.pdf

(2) All About Appraising: The Definitive Appraisal Handbook, Appraisers Association of America, pg 34

(3) P526, pg.10, Determining Fair Market Value